Most Unicorn Startups Will Not Overcome Their Cumulative Losses

Share prices for video service startup Zoom, social media startups Snap and Pinterest, e-commerce startups Etsy, Purple, Wayfair, and Peloton, and many others are up more than three times from pre-pandemic levels. Even Uber and Lyft’s share price are up more than 50% despite the lockdowns reducing demand for their services. And venture capitalists provided a record amount of funding for startups in the first quarter of 2021, and more Unicorns were created in the second quarter of 2021 than in all of 2020.

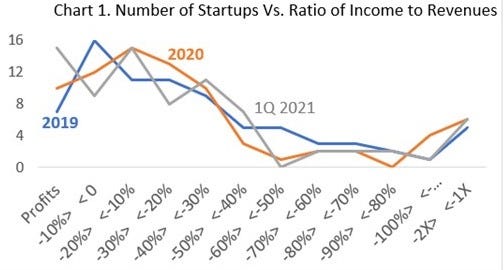

Behind this optimism is a belief that startup losses don’t matter, annual losses that are surprisingly high for many Unicorn startups (Chart 1) despite many existing for more than 10 years. Chart 1 shows the ratio of income to revenues for 77 startups that have done IPOs and that had greater than $1 billion in pre-IPO valuations. Less than 20% of these startups were profitable during the first quarter of 2021, and more than half had losses that were greater than 20% of revenues. For instance, in both 2020 and 2021, Uber and Lyft’s losses were greater than 50% of revenues, Snap’s greater than 30%, Airbnb’s more than 100%, and many business software startups such as Palantir, Snowflake, and Nutanix had losses greater than 50%.

The good news is that the number of profitable startups has slightly risen since 2019. Fifteen of America’s Unicorn startups were profitable in the first quarter of 2021, up from 10 in 2020 and seven in 2019. Moderna went from a big money loser to a big money winner on the backs of its Covid vaccine while GoodRX, a telemedicine provider, Coinbase, a crypto exchange and Corsair Gaming, a gaming company, went from losses in 2019 to profits in 2020 and 2021.

On the other hand, if we look at the number with either profits or losses less than 10% of revenues (the two categories on the left), the numbers have barely changed. The number of Unicorn startups in these two categories were 23 in 2019, 22 in 2020, and 24 in the first quarter of 2021.

The bigger problem is that one-half of Unicorn startups in Chart 1 had losses greater than 20% of revenues and one-fourth had losses greater than 40% of revenues. The optimists will argue that Amazon became profitable after years of losses, so why can’t others. As America’s biggest money-loser among the most successful startups of the last 50 years, it did not turn a profit until its 10th year of existence and its profits did not cover its peak cumulative losses of $3 billion until year 16. But it is now one of the most valuable companies in the world. If Amazon could do this, why can’t today’s money-losing Unicorn startup?

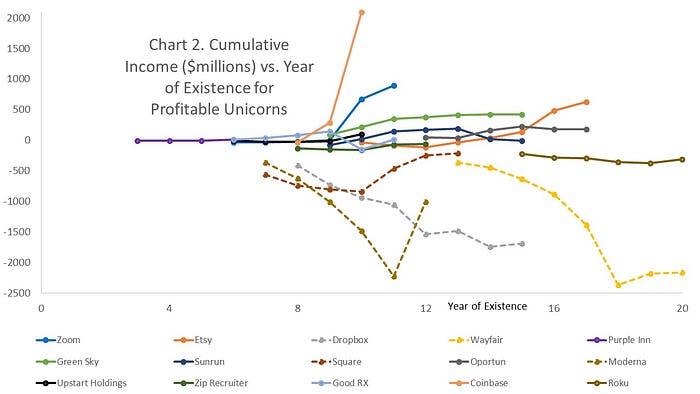

In fact, some Unicorn startups are doing far better than Amazon ever did. Chart 2 shows cumulative income vs. year of existence for startups profitable in either 2019, 2020, or 2021 (Corsair Gaming is not shown because it is off the chart, in its 27th year of existence). Coinbase, Zoom, Purple, Etsy, and GoodRX have been profitable or close to profitable for years, as have fintech providers Green Sky, Oportun, and Upstart Holdings, solar installer Sunrun, digital streaming technology Roku, and employment marketplace Zip Recruiter. These startups never experienced the big losses that Amazon did, and they may be profitable for years to come.

On the other hand, a few did have big losses before becoming profitable of which Moderna is the most notable. Others include fintech providers Oportun and Square, e-commerce provider Wayfair, and online storage provider Dropbox. Nevertheless, these startups are clearly the exceptions in Chart 2, as is Amazon in the history of America’s startups. Most of America’s successful startups, either those of today or those of decades past, achieved profits fairly quickly.

The more depressing news is that many of today’s Unicorn startups have far bigger losses than those of Amazon. Chart 3 compares Amazon’s cumulative losses over time (in red) with the biggest money losing Unicorn startups. Cumulative losses are graphed vs. year of existence to better compare Amazon with today’s startups. In the case of the startups, the final year of data for each company is for the first quarter of 2021 and thus is only for one quarter as compared to an entire year for the other years. All the data is in current dollars and thus Amazon’s cumulative losses would be higher if they were adjusted for inflation.

Chart 3 shows that several Unicorn startups have vastly exceeded Amazon’s peak cumulative losses of $3 billion in 2002. Uber’s cumulative losses have exceeded $23 billion while those of Snapchat have exceeded $8 billion, Airbnb and Lyft $7 billion, Palantir $6 billion, and Nutanix $5 billion. Bloom is close with $2.5 billion. Recent estimates for WeWork, which has not done an IPO, put their cumulative losses at about $10 billion in March 2021. Despite these huge losses, however, many of these startups have huge valuations. Snap, Airbnb, and Uber are currently valued at between $90 and $100 billion while Palantir is valued at $46 billion, and Lyft at $20 billion; (Nutanix and Bloom Energy have much smaller valuations). In comparison, Amazon’s market capitalization didn’t pass the $20 billion mark until 2003, and this was after it had achieved profitability.

And the losses for these startups continued to grow in 2021, partly obscured by the single quarter losses of 2021 being compared to full year losses for the previous years. Other than Bloom, all these startups are on track to add at least $1 billion to their existing cumulative losses in 2021. Uber’s 2021 data point is particularly misleading because its $100 million losses included the $1.6 billion in income from the sale of its autonomous vehicle unit. Without that sale, Uber’s first quarter losses would have been $1.7 billion or $6.8 billion on an annualized basis. $30 billion in cumulative losses by the end of 2022 is highly likely.

The cumulative losses for many other Unicorn startups are also rapidly growing, exceeding $1 billion, and may well reach those of Amazon’s peak losses (in red) in the next few years. Charts 4 and 5 compare the cumulative losses vs. year of existence for 18 Unicorn startups that were still unprofitable in either 2020 or 2021. Chart 5 is for those with cumulative losses between $1.5 and $2.5 billion and Chart 6 is for those between $1 and $1.5 billion. Six of them (40%) now have valuations greater than $50 billion (DoorDash is 58, Snowflake 70, Pinterest 51, Docusign 54, Twilio 66, OpenDoor 72, all in billions of dollars) and another six are greater than $20 billion. Clearly, the market believes that these losses can be overcome.

Yet the charts suggest that only one of these startups might now be achieving a turnaround despite most of them benefiting from the lockdown. With cost rising less than the 50% increase in revenues during the pandemic lockdown, Pinterest may be on its way to profitability with its losses dropping in 2020 and the first quarter of 2021. The losses for the rest, however, were still growing at the same rate in 2020 as before, and even at the same rate in the first quarter of 2021 if we adjust the distances along the x-axis for the single quarter results.

These cumulative losses are also still growing despite at least 10 years since their founding for all but two of them, and more than 15 years for six of them, all business software providers (Unity Software, UIPath, DocuSign, Box, Cloudera, and MongoDB). Remember that Amazon had achieved profitability by year 10 and covered its cumulative losses by year 16. It is hard to imagine that these six Unicorn startups, nor any of the startups in Charts 4 and 5 outside of Pinterest, could ever obtain profits that cover their cumulative losses.

There are also 17 more Unicorn startups with cumulative losses greater than $500 million. These are Carvana, Blue Apron, Quotient Technologies, Vroom, Casper, New Relic, Coupa, Roblox, Zscaler, Medallia, Roblox, Anaplan, Domo, Affirm, Lending Club, Amwell, and Squarespace. Eleven of them have cumulative losses greater than one year revenue. Therefore, even if these startups achieve profits equal to 10% of their revenues, which is unlikely in itself, it will take more than 10 years for them to overcome their cumulative losses.

Amazon is clearly not a good role model for today’s money losing Unicorns. Just because one startup was able to succeed, no matter how much it has succeeded, does not mean that others will also succeed, particularly when Amazon had achieved profitability by its tenth year of existence. Most of today’s profitable startups achieved profits fairly early (Chart 2), yet most of today’s money-losing Unicorns are far older than 10 years, many are older than 15 years. Moreover, the cumulative losses for many of these startups continue to rise with no turnaround in sight. Amazon’s history suggests that the biggest money losing Unicorn startups may never achieve profitability on a cumulative basis, or at least it will take so long that it doesn’t matter.

On the other hand, their high share prices suggest that investors don’t care about losses. The low interest rates and large exuberances mean that investors may tolerate these high losses for much longer than rational analysis suggests they should.

Methodology

Income data was gathered from Yahoo Finance and from SEC-1 filings by startups that have been defined as Unicorns (more than $1 billion valuation) and that release income data. No special purpose acquisition companies (SPACs) or liquidations (e.g., Katerra) are considered. Market capitalization data was collected from Yahoo Finance.